DISTILLING THE BEST IDEAS.

Latest News

|

Notice of Unit Holders’ Meeting of Astute Dana Al-Faiz-I (the “Fund”) |

Dear Valued Investors, | |

Astute Dana Al-Faiz-I (ADAF-I) |

|

The Spirit of 1957 |

Message from CEO, Mr Clement Chew | |

|

Notification on Proposed Amendment of Master Prospectus |

Dear Valued Investor, | |

|

|

Position: Senior Analyst / Analyst | |

|

|

Position: Compliance Officer/ Executive | |

|

Important Notice: Beware of Scammers Misusing Astute Fund Management Berhad’s Name and Logo |

Dear Valued Clients and Agents, | |

|

Selamat Hari Raya Aidilfitri |

Dear valued Astute Partner , | |

|

Gong Xi Fa Cai |

Dear Colleagues and Partners, | |

|

Message from CEO |

Dear Client/Stakeholder/Partner, | |

|

ASTUTE CEO’s Message for 2024 |

Dear Stakeholder, | |

|

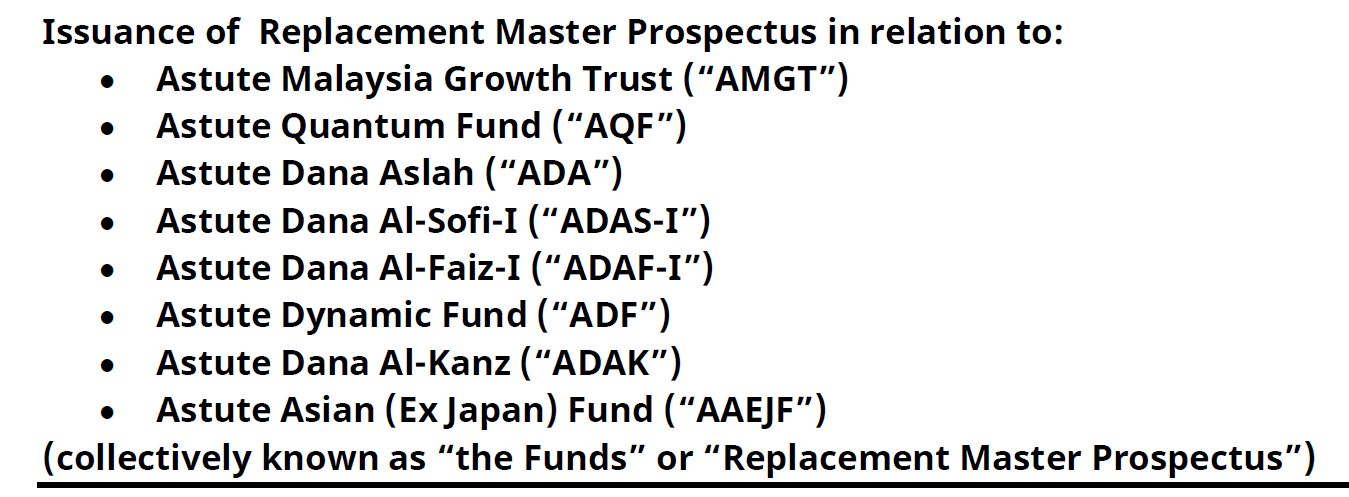

Notice: Replacement Master Prospectus |

Dear Valued Investor, | |

|

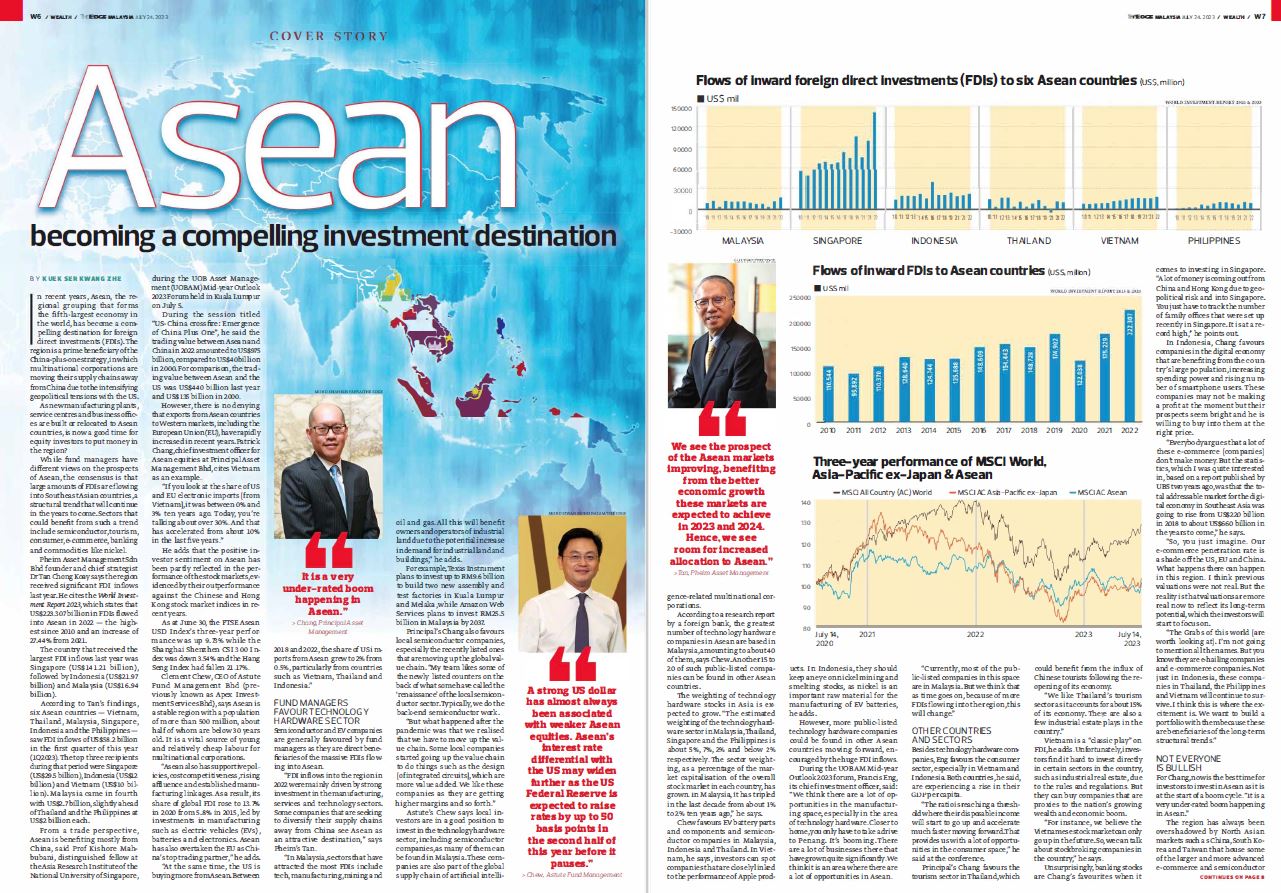

Article: Astute's views on Asean becoming a compelling investment destination |

Dear Valued Clients, | |

|

Unit Trust Consultant |

Job Responsibility | |

|

Astute's Portfolio Managers’ Views |

Dear Valued Clients, | |

|

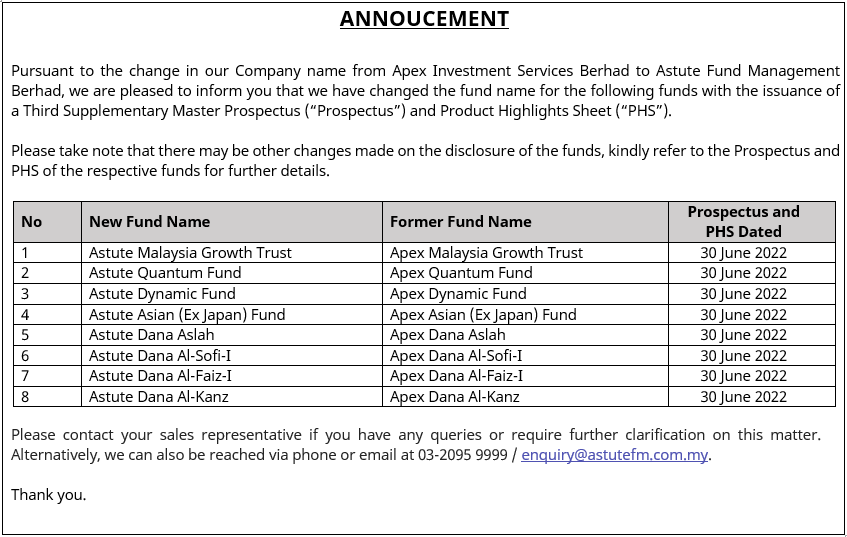

ANNOUCEMENT : Change in Funds Name |

Pursuant to the change in our Company name from Apex Investment Services Berhad to Astute Fund Management Berhad, we are pleased to inform you that we have changed the fund name for the following funds with the issuance of a Third Supplementary Master Prospectus (“Prospectus”) and Product Highlights Sheet (“PHS”). | |

|

Announcement - Shareholding changes |

Dear Client/Consultant/Investor, | |

|

Article: Apex's views on Investors remain in a risk-off mode currently |

Dear Valued Clients, | |

|

Article: Apex's views on Millennials and Gen Z reshaping asset management industry |

Dear Valued Clients, | |

|

Article: Apex's views on Foreign funds to be hit by FSIE withdrawal? |

Dear Valued Clients, | |

|

Article: Apex's views on Omicron reignites fear, but 'No' to mass lockdown |

Dear Valued Clients, | |

|

Article: Apex's views on Swift reopening policy consistency key to economic recovery |

Dear Valued Clients, | |

|

Article: Apex's views on Investors hoping for positive changes to drive the market higher |

Dear Valued Clients, | |

|

Article: Apex's views on Money managers remain invested in stocks and time |

Dear Valued Clients, | |

|

Article: Apex's views on New Generation Of Wealth Creators |

Dear Valued Clients, | |

|

Revision of Sales Charge for Unit Trust Investment under EPF-MIS |

Dear Valued Clients, | |

|

ANNOUNCEMENT |

Apex Investment Services Berhad (“AISB") was made aware of a fictitious page on Facebook. | |

|

MESSAGE FROM THE CEO |

Dear valued investors and partners, | |

|

SALES AND SERVICE TAX ANNOUNCEMENT |

Effective 1 September 2018, the Ministry of Finance has announced that the Sales and Service Tx (“SST”) will replaced the Goods and Services Tax (“GST”). | |